Last year was historic for billion-dollar climate disasters in the U.S. Twenty-eight separate events struck as shown in this figure from the National Oceanic and Atmospheric Administration (NOAA)[1]:

Figure 1. NOAA Summary of U.S. Billion-Dollar Disasters

That is about 20 more annual events than the long-term average. As shown below, each of the past four years has exceeded the long-term average of extreme events.

Figure 2. NOAA Summary of U.S. Billion-Dollar Disaster Trend

On March 28, 2024, the U.S. Securities and Exchange Commission (SEC) introduced new rules aimed at helping investors understand the climate risks companies face. As they say in the preamble to the final rule:

Climate-related risks, their impacts, and a public company’s response to those risks can significantly affect the company’s financial performance and position . . . Many investors . . . currently seek information to assess how climate-related risks affect a registrant’s business and financial condition . . . Investors also seek climate-related information to assess a registrant’s management and board oversight of climate-related risks so as to inform their investment and voting decisions.[2]

The “Enhancement and Standardization of Climate-Related Disclosures for Investors”[3] effective date is May 28, 2024[4]. The due dates for disclosure vary depending on the filing status of SEC registrants as shown in the table below. The SEC estimates that some 2,700 U.S. companies and hundreds of foreign companies filing with the SEC will be affected by the rules to be codified in 17 CFR §§ 210, 229, 230, 232, 239, and 249.

Table 1. SEC Climate Disclosure Rule Applicability and Compliance Dates by Fiscal Year

1) greater than $700 million public float (generally the value of outstanding stock held by public investors)

2) Between $75 and $700 million of public float but not smaller reporting companies and emerging growth companies

3) Non-accelerated filers are generally those with public float less than $75 million

SEC’s final rule is significantly different from what was proposed in March 2022 due to the 24,000+ comments received: the most for any SEC rule-making in its 90-year history.[6] A point-by-point discussion of those changes can be found in the 240-page preamble to the final rule but possibly the most significant change for most reporters, as indicated in Table 1 Item 3, is that Scope 3 greenhouse gas (GHG) emissions disclosure is not required. One thing that has not changed is the four-part structure of required disclosures that is derived from the Task Force on Climate-Related Financial Disclosure (TCFD).[7] Those four parts and their corresponding rule sections are governance (§229.1501), strategy (§229.1502), risk management (§229.1503), and targets and goals (§229.1504). Those four parts have been used by TCFD since 2017 to represent the core elements of how organizations manage risk.[8] As illustrated in Figure 3, the TCFD structure consists of:

Governance – the leadership and decision-making structure

Strategy – wherein an organization identifies risks and their associated impacts

Risk Management – where processes aimed at assessing and managing risks are identified and managed

Targets & Goals – where organizations gather data to assess performance

Figure 3. The TCFD Four Pillars of Climate Risk Disclosure

With that as context, let’s take a look at key requirements within each of these four areas.

Governance (§229.1501)

The SEC’s stated intent in this section is to “enhance investors’ ability to evaluate a registrant’s overall management of climate-related risks by improving their understanding of the board’s role in overseeing those risks.”[9] The rulemaking does not oblige organizations to “shift governance behaviors” only to disclose how they oversee climate-related risks. No disclosure is required if there is no relevant information. But if applicable, disclosure requirements include any committee(s) responsible for climate-related risk oversight; processes used to inform the board of risks; if targets or goals are set, how progress toward them is overseen; and how management assesses and manages material climate-related risks. Governance topics must be disclosed per the schedule for Item 1 in Table 1.

Strategy (§229.1502)

Climate-related risks are defined in the rule as “the actual or potential negative impacts of climate-related conditions and events on a registrant’s business, results of operations, or financial condition.”[10] Consistent with TCFD precedent, the SEC categorized climate-related risks as either physical or transition. Physical risks may impact a business acutely such as short-duration wildfires, flooding, and severe storms, or chronically such as long-term changes in sea level, rising air temperatures, or increased drought. Transition risks are associated with the societal transition to a low-carbon economy and include topics such as changes in law or policy, changes in market demand for carbon-intensive products, devaluation of carbon-intense processes or products, and reputational risks associated with the inability to achieve stated climate-related goals.

To the extent an organization has identified material impacts from such risks, disclosure of them relative to both the short-term (next 12 months) and long-term (greater than the next 12 months) is required. Also required as strategic disclosures are discussions of scenario analysis methodologies and internal carbon prices, if applicable. These strategy elements would be disclosed following the timeframes for Item 1 in Table 1 except for these two expenditure-related topics, if applicable, that companies have an extra year to address (see Table 1, Item 2):

- §1502(d)(2): quantitative and qualitative descriptions of material expenditures to mitigate or adapt to climate-related risks

- §1502(e)(2): quantitative and qualitative descriptions of material expenditures and material impacts on financial estimates as a direct result of any transition plan (meaning any plans that have been developed to manage material transition risks)

Risk Management (§229.1503)

The risk management aspects of disclosure address how an organization identifies, assesses, and manages material climate-related risks. These elements also fall under the timing for Item 1 in Table 1. Information to be provided, as applicable, includes:

- how the organization identifies if they have or could incur a material risk

- how they decide whether or not to mitigate or adapt to any risks

- how those risks are prioritized

- if risks are being managed, then how climate-risk management processes have been integrated into the overall organizational risk management system

Targets and Goals (§229.1504), Metrics (§229.1505), and Assurance (§229.1506)

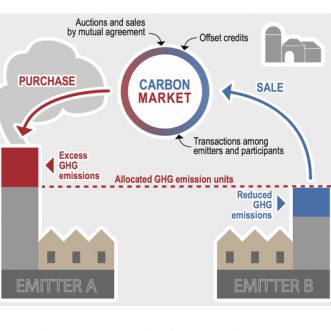

Organizations must disclose the extent to which GHG reduction targets (e.g., net-zero by 2050) or specific goals (e.g., 30 percent reduction from baseline by 2030) have materially affected their company. Elements of the disclosure will include the scope of the emissions (i.e., 1, 2, or 3), units of measurement (typically CO2e), the specific time horizon, the baseline year, and a discussion of how they intend to meet the goal. Progress made toward achieving any goal is also required. Also, if carbon offsets or renewable energy credits are material to achieving targets or goals, specific disclosures are required about them. All of these elements fall under the timing for Item 1 in Table 1 with the exception of an additional requirement. That is if the organization has had material expenditures or impacts as a direct result of a target, goal, or actions taken to meet them, then a quantitative and qualitative description of those expenditures and impacts on financial estimates is required according to the timing for Item 2.

Relative to GHG emissions, the rule states that a registrant “must disclose its Scope 1 emissions and/or Scope 2 emissions, if such emissions are material.” This is in contrast to existing Environmental Protection Agency reporting requirements at 40 CFR 98 that require certain categories of sources that emit more than a specific threshold of GHG to report annually. It is also different in scope than the voluntary disclosures that many corporations have provided in annual sustainability reports. Such voluntary disclosures prompted the SEC to send letters to corporations inquiring as to the materiality of those disclosures. Now, the burden will be on organizations to assess for themselves whether their GHG emissions are material or not. While the rule does not require the reporting of Scope 3 emissions, if corporations have established material targets or goals and they have included Scope 3 emissions in their accounting of progress toward those goals, then they would be required to disclose similar information as for the Scope 1 and 2 emissions. As shown in Table 1, material GHG emission disclosures will be required for large corporations with the FY 2026 filings.

The final element addressed here concerns requirements to demonstrate that any GHG emission figures being disclosed can be relied on. Two forms of attestation are specified: limited assurance (essentially a technical review) and reasonable assurance (a more formal audit). These provisions do not take effect until several years after the initial disclosures as shown in Table 1, Items 4 and 5. Requirements for who can provide assurance and how it is to be documented are stated in the final rule.

Conclusion

Despite the April 4 implementation stay and the legal proceedings that will determine the final form of this rulemaking, the characterization of GHG emissions and the assessment of climate-related risks have already become common for major corporations. The SEC cites research performed on 52,778 annual reports from 2016 through 2022 that illustrates the presence of climate-related keywords in filings has increased from about 12 percent to about 40 percent over that time.[11] Another figure illustrates by industry sector the percentage of filings that contain climate-related keywords.[12] It shows that 85 percent or more of businesses in the electric services, maritime transportation, steel manufacturing, and paper & forest products industries are already mentioning climate-related topics. The same figure points out that in many other sectors including chemicals, textiles, mining, and automotive, there tend to be far fewer filings that mention climate-related topics. Whether these differences are because climate risk has been determined to be less material to some sectors or governing bodies in some sectors have been more focused on these matters than others may become apparent as SEC filers are required to take a consistent look at climate risk disclosure. When combined with the emerging domestic climate rules such as those in California and existing related disclosure requirements in the EU, we will likely all be hearing more about corporate carbon footprints and how they are managing their exposure to the next climate catastrophes.

If you have questions about these new requirements or need help with greenhouse gas and climate risk assessment and disclosure, contact our subject-matter experts for help:

Kris Macoskey | Air Quality Vice President

kmacoskey@cecinc.com, 412.249.3147

[1] 2023: A historic year of U.S. billion-dollar weather and climate disasters | NOAA Climate.gov

[4] Due to numerous legal challenges, on April 4 the SEC voluntarily paused rule implementation which means that the actual effective date will most likely be delayed.

[5] Materiality, as used here, refers to the SEC definition at 17 CFR 230.405: “The term material, when used to qualify a requirement for the furnishing of information as to any subject, limits the information required to those matters to which there is a substantial likelihood that a reasonable investor would attach importance in determining whether to purchase the security registered.”

[6] https://www.sec.gov/news/press-release/2024-31 and

https://news.ufl.edu/2024/03/sec-climate-disclosure-rules/#:~:text=After%20announcing%20its%20initial%20proposal,received%20for%20an%20SEC%20rule

[8] TCFD, Recommendations of the Task Force on Climate-Related Financial Disclosures, June 2017, available at https://assets.bbhub.io/company/sites/60/2021/10/FINAL-2017-TCFD-Report.pdf

[11] See Figure 1, 89 FR 21836

[12] See Figure 2, 89 FR 21838

Post a Comment